Yay! You Got the Money – Money Management

Once you have raised the funds you will need to move forward with your project, you need to think about how you will handle cash flow and cash control. Even if the funds never go directly to you, but rather to a community organization, you still need a system for managing the cash.

Many organizations that grant money require final reports including financial tracking and receipts. In small, short-term projects you do not need to be an accountant to manage the cash flow. You do, however, need to have bookkeeping skills, which require consistent recording of all transactions. If your project grows into a small business, you will need these same bookkeeping skills and you may need to hire an accountant. The two most important things you need are a project budget and a consistent way to track transactions.

Some tools you will need:

- A receipt book to track any money coming in

- A computer or paper budget sheet

- An envelope to keep receipts

- Cheques

A Simple Method of Tracking Money

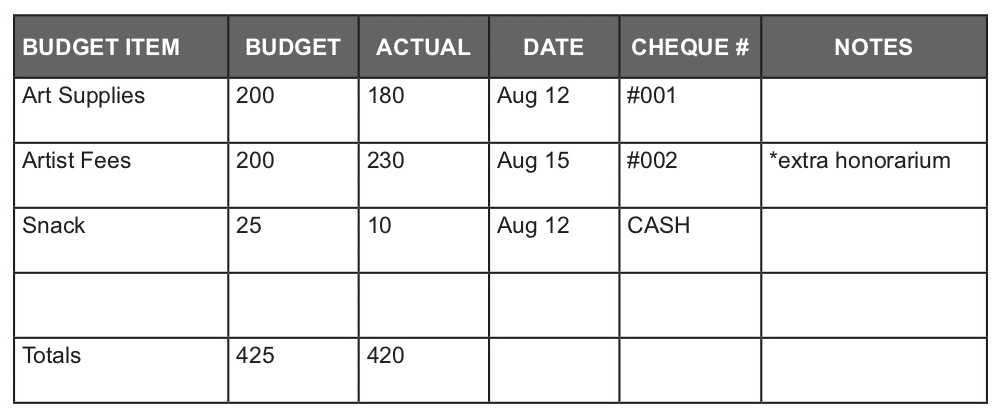

Even if another organization is handling the money and reporting, it is important for you to know what is going on financially. One of the simplest methods to manage cash flow is a spreadsheet. Each item of your budget is on the left, followed by a column titled “Budget” and then another column “Actual”. Other columns you can add are cheque #, receipt #, date, notes, plus any other item you want to keep track of. This method works surprisingly well as long as you maintain the spreadsheet. You can create this cash tracking system in a program such as Excel. If you don’t have access to Excel, a table in Word works, or a table on paper.

Below is an example of this simple tracking system. This system is ideal for small budgets, and where cash flow is easily accessed.

This method also lets you know when you have gone over a particular budget item, so you can adjust the rest of the budget or look for more funding. This is called cash-based accounting

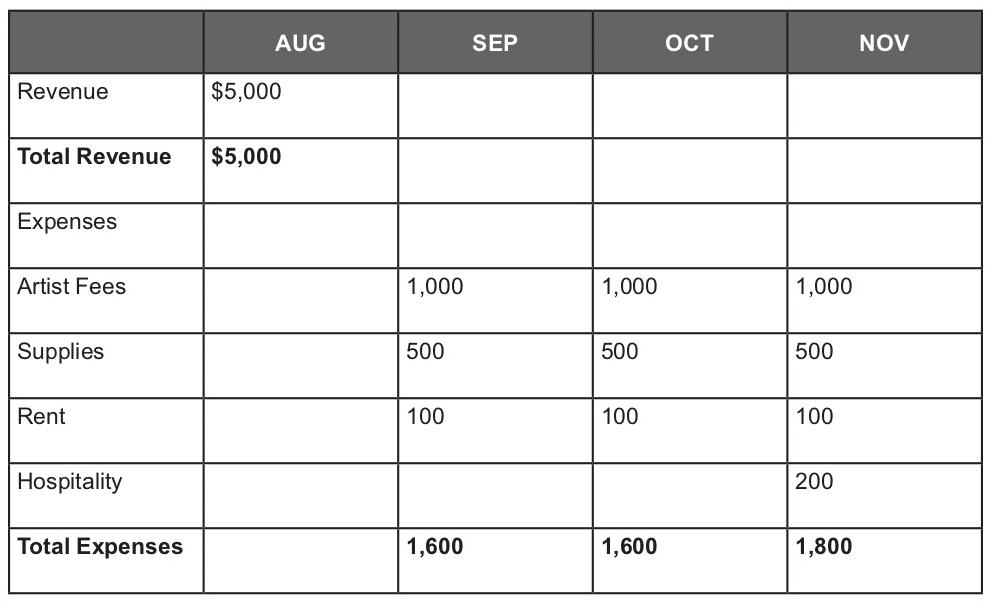

In addition to the previous spreadsheet, you may find it helpful to create a monthly cash flow sheet that shows when all the money budgeted will get spent. This helps you to budget for each month. Granting agencies and funders do not need to see your cash flow statements.